Would a New Policy on Pot Be Good for the US?

Economists consider the societal impact of reclassifying marijuana.

Would a New Policy on Pot Be Good for the US?

When the stock market dropped in March and April of 2020, demand for US Treasurys—usually a safe haven during stock market tumult—seemed to drop. This could have been a sign of ominous economic tides: a loss of faith in US debt, or rising inflationary expectations. But Chicago Booth’s Zhiguo He and Stefan Nagel and Johns Hopkins’s Zhaogang Song find evidence for a regulatory explanation.

(calm electronic music)

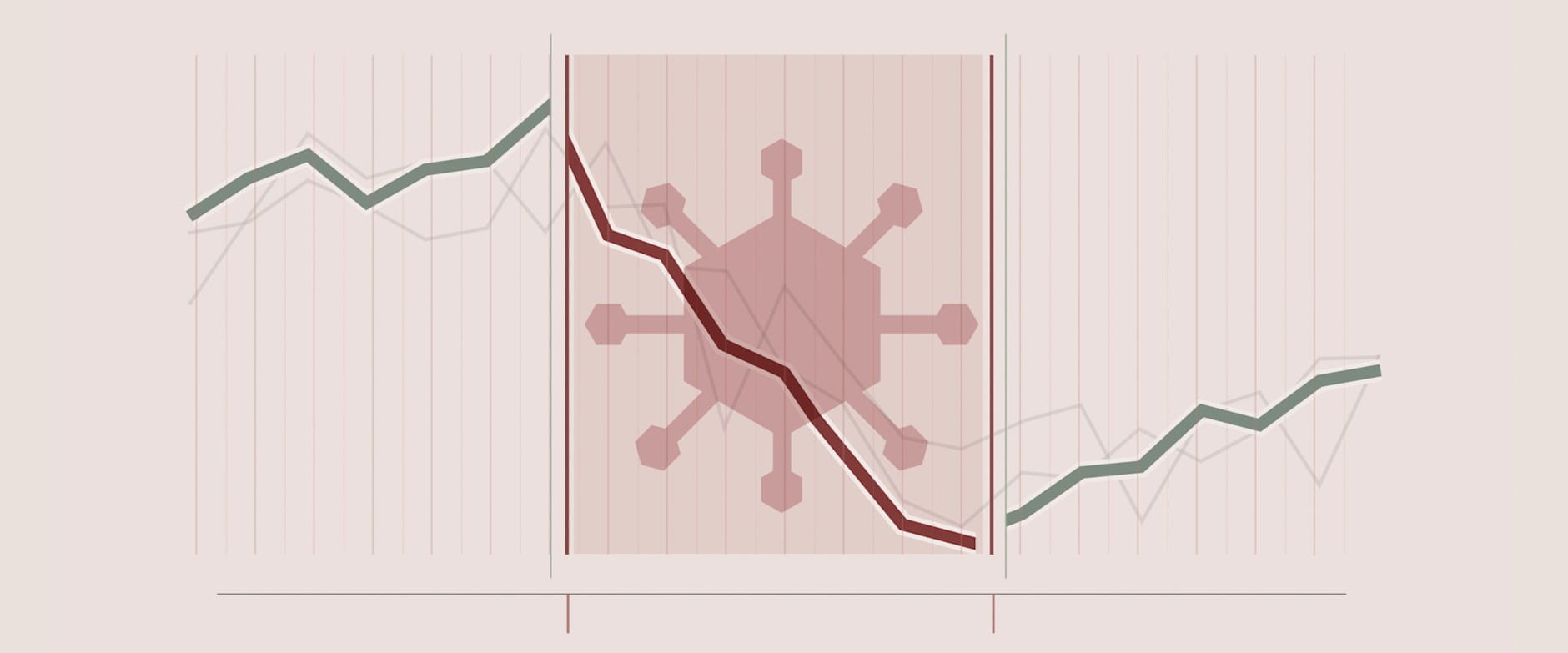

Narrator: US Treasury yields have long been considered one of the world’s safest investment assets, a place to seek refuge when stock markets plunge. However, during the COVID-19 stock crash in March and April of 2020, prices of Treasury bonds plunged along with stock prices. Some wondered if this signaled that global investors were losing confidence in US debt—or if it was an omen to rising inflation. Chicago Booth’s Zhiguo He and Stefan Nagel, along with John Hopkins’s Zhaogang Song, point to a rule originally introduced as a safeguard after the 2008–2009 financial crisis called the supplementary leverage ratio, or SLR. This rule, coupled with the fact that large institutions and global central banks were scrambling for quick liquidity, created a situation where capital couldn’t respond quickly enough to the market’s needs during the COVID crisis.

The researchers argue that the inefficiencies of the SLR rule were exposed when, as is typical, bond dealers facilitated short-term borrowing or lending activities associated with Treasurys. They do this through what is known as repo and reverse-repo transactions. But with the SLR rule, regulators required bond dealers to have equity funding equal to 3 to 5 percent of their repo exposure as protection in the event that the repo counterparty defaulted and the Treasury bonds that serve as repo collateral lost value. This requirement didn’t cause a problem for dealers involved in these activities until market participants suddenly rushed out of long-term Treasurys and into short-term ones with maturity of less than a year or into cash deposits. Then the system simply seized up, and dealers couldn’t move fast enough for the market’s needs.

To remedy this situation, the Treasury and the Fed temporarily suspended the SLR rule on April 1st. The Fed also conducted massive purchases of Treasury securities. Bond markets have functioned normally ever since. The researchers warn in order to avoid situations where Treasury markets seize up in times of stress, the Fed needs to ensure better bond market liquidity in the future.

Economists consider the societal impact of reclassifying marijuana.

Would a New Policy on Pot Be Good for the US?

Columbia’s Joseph Stiglitz discusses causes of and solutions to market failures and inefficiencies.

Capitalisn’t: Joseph Stiglitz’s Vision of a New Progressive Capitalism

It’s even effective in identifying risks related to AI itself.

AI Reads between the Lines to Discover Corporate RiskYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.