The Equation: NFTs and the Power of Social Influence

- June 03, 2024

- CBR - Finance

The late economist Gary S. Becker once asked why a successful restaurant would avoid raising prices despite a long queue of customers. The answer, he suggested, lies in the fact that for certain products, how much one person wants the item is influenced by how much other people also want it—which makes demand quite fragile. A trendy restaurant that raises prices even by a little can quickly become unpopular.

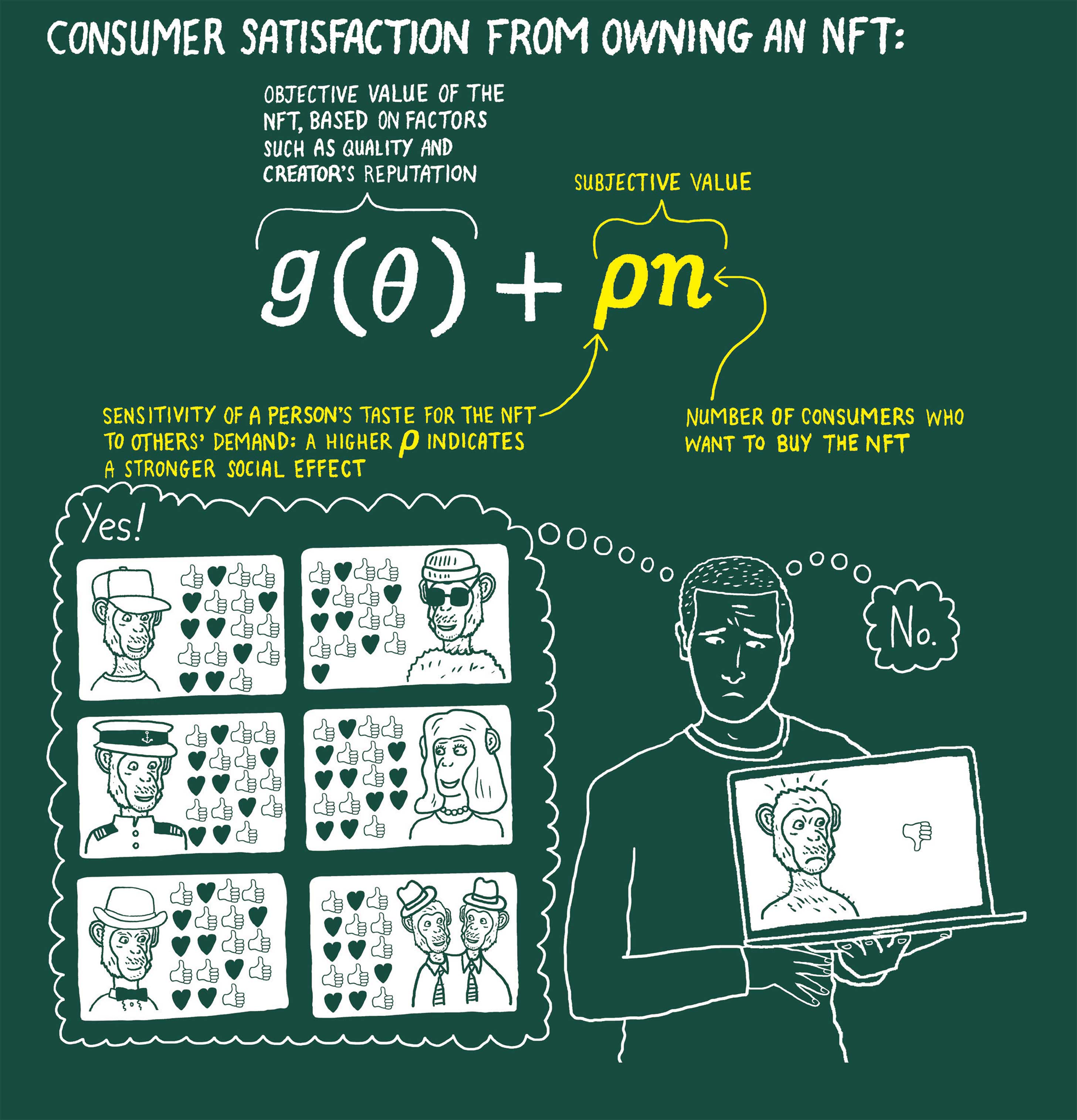

The same dynamic extends to nonfungible tokens, according to recent research by Temple University’s Sebeom Oh and Samuel Rosen and Chicago Booth’s Anthony Lee Zhang. The satisfaction that a consumer derives from owning part of an NFT collection hinges on two things: an objective value on which everyone agrees, and a subjective one that’s linked to other consumers’ valuations. The latter, social component is why some NFT collections sell out while others sell poorly, and it’s also why issuers often underprice NFTs and limit their supply, according to the research. To learn more, read “How NFTs Defy the Laws of Supply and Demand.”

Illustration by Peter Arkle

ChatGPT captures information missed by the market.

AI Can Discover Corporate Policy Changes in Earnings Calls

Investment manager Jim Chanos discusses short selling’s role in financial markets.

Capitalisn’t: Is Short Selling Dead?

Chicago Booth’s Raghuram G. Rajan joins hosts Bethany McLean and Luigi Zingales to explore risks in the financial system and possible solutions.

Capitalisn’t: Why the Banking Crisis Isn’t OverYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.