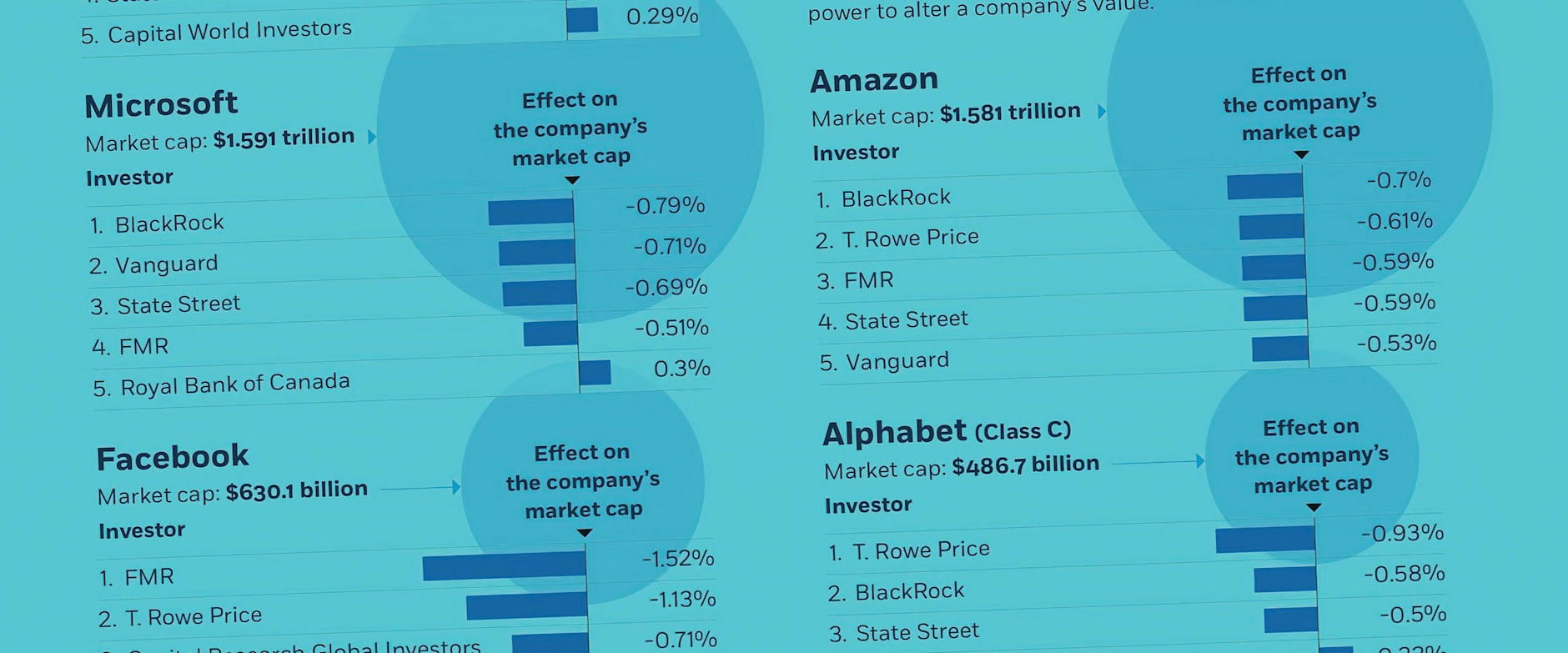

If stock prices deviate from their fair values, investors generally rush in to remedy the mispricing, according to traditional finance models. But Chicago Booth's Ralph S. J. Koijen, NYU's Robert J. Richmond, and Princeton's Motohiro Yogo find that some investors drive valuations more than others do. In a study of stocks at the close of the third quarter in 2020, the researchers calculated how much a company's market capitalization would have changed in a scenario in which an investor reacted to losing 10 percent of its assets. They ranked the results to identify those with the most individual power to alter a company's value, whether positive or negative.

Explore their findings below in a searchable database of more than 2,300 stocks, and read “Who Is Driving Stock Prices?” to learn more about this research.

Choose a stock to see its 10 most influential investors

- Ralph S. J. Koijen and Motohiro Yogo, "A Demand System Approach to Asset Pricing," Journal of Political Economy, August 2019.

- Ralph S. J. Koijen, Robert J. Richmond, and Motohiro Yogo, "Which Investors Matter for Equity Valuations and Expected Returns?" Working paper, December 2020.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.